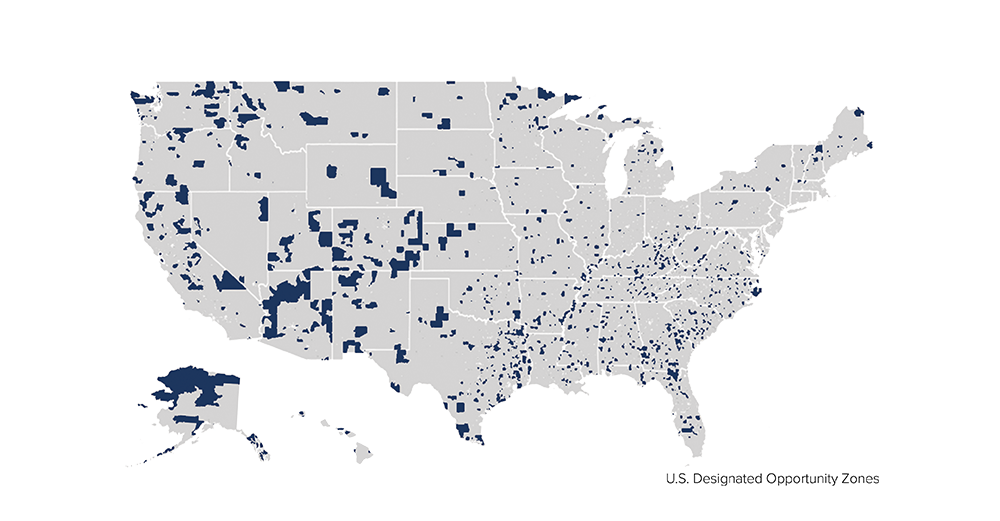

Opportunity zones were created as part of the Tax Cuts and Job Acts of 2017 to stimulate long-term private investments in low-income urban and rural communities nationwide. By providing tax benefits to investors, opportunity zone fund investments are intended to promote economic growth in distressed areas.